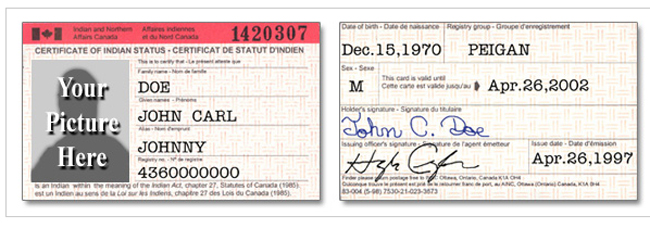

Adventures with Status Card and getting the PST exemption in Ontario

NOTE: PST point-of-sale exemption is only in Ontario. For more information visit www.anishinabek.ca/notax

NOTE: PST point-of-sale exemption is only in Ontario. For more information visit www.anishinabek.ca/notax

By Kristin Grant

In the two years since I got my status card, I try to use it everywhere and anyway I can and have had some interesting experiences doing so.

I live off-reserve in a community that isn’t particularly ethnically diverse. At times I feel like the only native, so much so it was a little jarring walking around the mall up in Sudbury a few weeks ago and seeing so many others First Nations. That being said it shouldn’t come as a surprise that when I use my status card not all cashiers are familiar with it. It is to the point, where I can actually tell baristas at my favourite coffee shop how to enter it into the system, because I’ve watched it explained so many times. Ironically when I inevitably hear “don’t get many of these” it makes me feel like a foreigner even though I have the card because I am descendant of the first peoples to inhabitant this land.

I am usually pretty patient and understanding when dealing with those that aren’t trained but I have my limits. I walked out of a store empty-handed recently because a cashier refused to first nations as “you guys”, argued about the fact that the taxes are harmonized and couldn’t figure out that it was supposed to be modified.

I find that there are inconsistencies in how this is used. At one fast-food place they were briefly taking off the tax for me, but then all of a sudden stopped, another gives in a 10% discount in lieu of the exemption at one location. Once at a convenience store the clerk was so befuddled they ended up charging me less than the cost of the item I was purchasing! One clothing store chain doesn’t apply the discount you have to call head office, conversely a Dollarstore chain takes off all the tax.

The method of application varies too, some they just enter it, some grocery stores can scan the barcode on the back, other places you practically have to sign your life away after filing out what can seem like a mountain of paperwork. An office supply store said I had to register for an account on their website in order to use it.

There are times when I feel really guilty because going through the tax exempt process can hold up a line especially when you have to fill out paperwork. Despite this when a guy behind me in line felt the need to tell other customers they may want to go another line because they are ringing me through tax exempt. I promptly turned around and told him he didn’t need to tell everyone my business. Would he have told everyone if I was doing a complicated return?

Within the past month I’ve had to ask three different cashiers to stop reading my card number out loud while entering it. I am not sure what anyone could actually do with it, last time the manager who was helping the cashier pointed out you need the card in hand but that is hardly the point, it is my personal info not meant to be publically broadcast. Who knows what kind of fraud could be committed if someone tried to for example get a replacement card?

I have even been judged for using my card. I was buying a drink at a Dollarstore and the cashier commented that she didn’t think I would use it for such a small amount. I do find it adds up to some decent savings, not that I’ve done an exact accounting. If you figure 5 trips a week to a high end coffee shop with the savings on tax over the year is $130 saved and that is just one place! There is also the plus that medication (to an extent) and eye exams every two years are covered. I faxed in my status info to my cable company and have the taxes adjusted through them even though I am off reserve. Of course there are those big ticket items, like when I bought my first brand new car it, my status card saved me over $1000.

Upon reflection despite the occasional hassle I am definitely glad I got my status card with the way the cost of everything seeming constantly goes up, every little bit helps!

Kristin Grant is part Cree, lives in Central Ontario and in her spare time does costumes for community theatre.

Editor’s note: For submitting receipts where the tax was not taken off at point-of-sale or for any fast food take-out receipts for meals over $4, download this form http://www.anishinabek.ca/uploads/0248E.pdf and send them to the Ministry of Finance.