Canada Revenue Agency looking or organizations to participate in volunteer program

The Canada Revenue Agency is looking for organizations to participate in a Community Volunteer Income Tax Program.

The Canada Revenue Agency is looking for organizations to participate in a Community Volunteer Income Tax Program.

The CRA provides participating community organizations and their volunteers with training, free income tax preparation software, access to a toll-free dedicated telephone line, surplus computers (when available) and promotional products and services.

Organizations determine when and how their clinic will be hosted – for example will it be a year-round, one-day or filing season only? Will it be a walk-in, by appointment, drop-off or home visit?

To host a clinic, organizations must provide a space and have internet access and paper filing.

Organizations screen and recruit their own volunteers.

What is in it for your community? Economical development, learn new skills, make a difference, gain confidence, take on a challenge and additional resources to support your organization.

Erin Jeffery, Outreach Officer for CRA says that Bearskin Lake First Nation had a very successful Community Volunteer Income Tax Program (CVITP) training session.

“This training session was the largest number of volunteers I had to date,” says Jeffery. “Eight women registered for the training, which is a large number of volunteers considering the population on reserve. Much of the credit goes to Billy Kamenawatamin, the Deputy Chief and to Monica Chapman for promoting our CVITP and recruiting volunteers. The volunteers were dedicated to learning the material and showed enthusiasm. I felt confident that when I left, the volunteers would be capable of completing income tax and benefit returns for people in the community.”

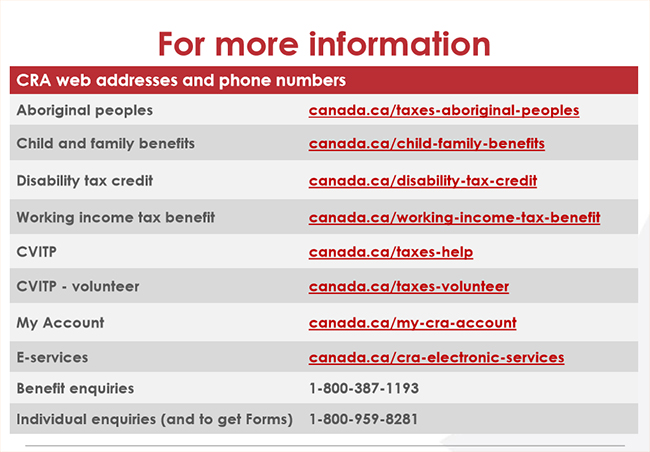

To become a VCITP volunteer, you must: affiliate with a community organization, be willing to learn basic tax information, register online at Canada.ca/taxes-volunteer , meet security requirements, apply for and EFILE account for electronic filing at Canada.ca/efile.

Training is available through webinar and in-person training. Training topics include seniors, Indigenous Peoples, medical expenses and disability, dependants, benefits and credits and Ufile Live.

For more information on the Community Volunteer Income Tax Program, contact:

Natasha Persaud, Regional Outreach Program Officer, natasha.persaud@cra-arc.gc.ca 416-973-8908 or 1-877-490-2293

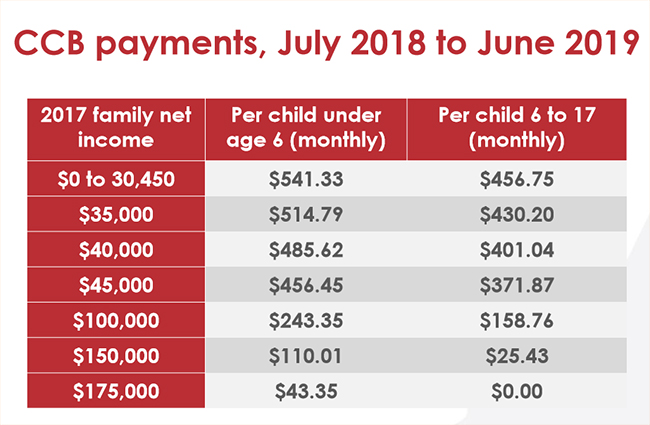

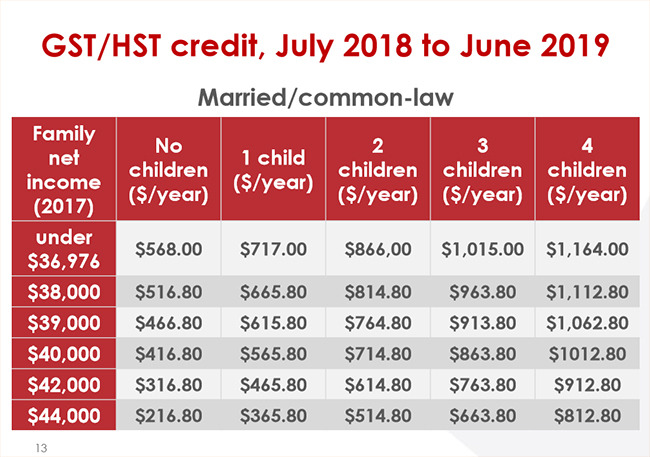

Not filing income tax? There are many benefits and credits you are missing ou t on. Even if you do not have an income, it is important to file.

t on. Even if you do not have an income, it is important to file.